An employee benefit known as voluntary life insurance provides beneficiaries with a monetary payout in the event that the insured employee dies. Voluntary life insurance allows employees to select higher coverage levels according to their own needs, in contrast to standard group life insurance, which offers a fixed coverage amount.

As Business Development Manager at Acrisure, I’m here to provide insights on voluntary life insurance, current market trends, and why it may be a valuable addition to your financial plan. For personalized support, feel free to reach out at 916-778-5979.

What is Voluntary Life Insurance?

Voluntary life insurance is an employee benefit that offers a cash benefit to beneficiaries if the insured employee passes away. Unlike basic group life insurance, which provides a set coverage amount, voluntary life insurance gives employees the option to choose higher coverage levels based on their individual needs.

Key Features of Voluntary Life Insurance

Flexible Coverage Options: Employees can select from various coverage amounts, often calculated in multiples of their salary or fixed sums like $50,000 or $100,000. This flexibility ensures that individuals can provide adequate financial support to their families.

Affordable Premiums: As it is purchased through an employer, voluntary life insurance is often more affordable than individual policies on the open market. Employers can secure favorable rates, benefiting employees with cost-effective premiums.

No Medical Exam: Many voluntary life insurance plans skip the medical exam, making it accessible for employees who might have health concerns that would typically make life insurance challenging to obtain.

Portability Options: Some plans allow employees to retain their coverage even after leaving the company, though they may need to pay the full premium themselves.

Additional Benefits and Riders: Many policies offer riders for added benefits, like accelerated death benefits for terminal illnesses or options to add coverage for dependents.

Types of Voluntary Life Insurance

| Type | Description |

|---|---|

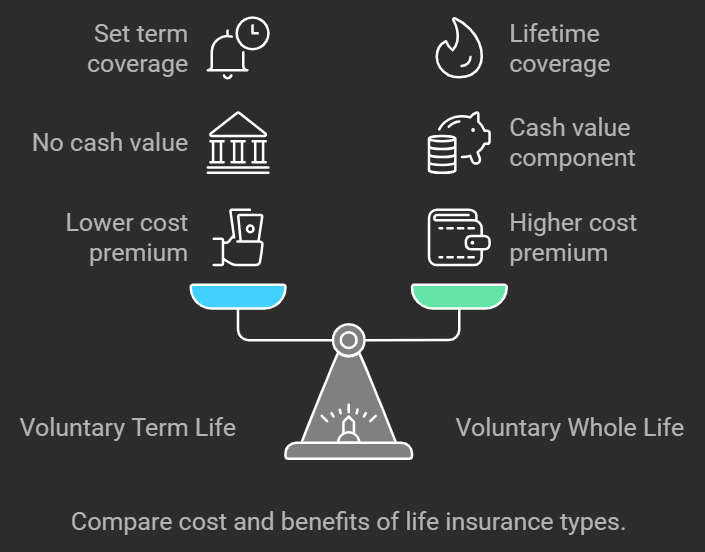

| Voluntary Term Life | Offers coverage for a set term (e.g., 10, 20, or 30 years). Generally more affordable but without cash value. |

| Voluntary Whole Life | Provides lifetime coverage with a cash value component that grows over time. More expensive but with lasting benefits. |

- Voluntary Term Life Insurance: Covers a specified period and is more affordable. It does not accumulate cash value and ends after the term unless renewed.

- Voluntary Whole Life Insurance: A permanent policy that provides lifetime coverage, so long as premiums are paid. This type includes a cash value component, making it a financial asset over time.

Why Consider Voluntary Life Insurance?

Voluntary life insurance offers key benefits, making it a popular choice for those who want enhanced financial protection.

- Enhanced Financial Security: Provides your beneficiaries with financial support, covering critical expenses like mortgages, education costs, and daily expenses.

- Supplemental Coverage: Basic employer-provided life insurance may not be enough for everyone. Voluntary life insurance enables you to supplement this coverage without having to buy a separate policy.

- Convenience: Enrollment is usually quick and easy during open enrollment periods or when starting a new job, making it a hassle-free way to secure extra protection.

Market Trends in Voluntary Life Insurance: USA and UK

In both the United States and the United Kingdom, the demand for voluntary life insurance continues to grow as employees seek more control over their coverage. Here’s a quick look at recent trends:

United States: Approximately 58% of large U.S. companies offer voluntary life insurance as a supplemental benefit. Increasing healthcare costs and an aging population are driving demand for this added coverage.

United Kingdom: In the UK, voluntary life insurance has become a staple in workplace benefits. Employers are increasingly including it as part of wellness programs to support employee well-being. About 45% of employers offer voluntary life insurance, according to recent market data.

Leading Companies for Voluntary Life Insurance

| Company | Key Benefits |

|---|---|

| MetLife (USA) | Known for flexible coverage options, cost-effective premiums, and comprehensive term and whole life policies. |

| Legal & General (UK) | Popular for easy enrollment and affordable rates for term and whole life options. |

| AIG (USA & UK) | Offers competitive rates and strong customer service with options for both portability and riders. |

How Acrisure Can Help

At Acrisure, we specialize in connecting clients with the right insurance options for their needs. With access to numerous providers and a deep understanding of the life insurance market, we can guide you in finding the best voluntary life insurance policy tailored to your financial goals.

To learn more or get a customized quote, please feel free to reach out to me, Abdul Aslam, Business Development Manager at Acrisure. I’m here to help you find the ideal coverage for you and your family. Call 916-778-5979 or visit www.abdulconnects.com for more information.

Final Disclaimer

This article provides general information, not financial advice. Life insurance options and rates vary by provider and individual circumstances. Please consult an insurance professional or advisor before making any decisions to ensure you have the best plan suited to your needs. Thank you for visiting abdulconnects.com!