What is Life Insurance?

Life insurance is a contract between you and an insurance company. In exchange for premium payments, the insurance company agrees to pay a sum of money (death benefit) to your designated beneficiaries when you pass away. The main goal of life insurance is to provide financial security for your loved ones by covering significant expenses like mortgage payments, funeral costs, and daily living expenses.

Life insurance is typically categorized into two main types: term life insurance and permanent life insurance. Each serves different financial planning needs depending on factors such as how long you want the coverage to last and whether you want to build savings within your policy.

What is Term Life Insurance?

Term life insurance is one of the most straightforward and affordable forms of life insurance. It provides coverage for a specific period—usually between 10 and 40 years—and if you pass away during that term, your beneficiaries receive the death benefit. However, if the term expires while you’re still living, the coverage ends without any payout.

Term life insurance is a popular choice because of its affordability, especially for younger people who want significant coverage to protect their families. Unlike whole life or universal life insurance, term policies don’t build cash value, which keeps premiums lower

Types of Term Life Insurance:

- Level Term: Both premiums and death benefit remain constant throughout the policy’s term.

- Decreasing Term: The death benefit decreases over time, typically used for covering a decreasing debt like a mortgage.

- Convertible Term: Allows you to convert the term policy into a permanent one before it expires, usually without a medical exam.

The Impact of Life Insurance on Families

Life insurance can be a game-changer for families, providing financial peace of mind in the event of an unexpected death. Without life insurance, families may face financial strain, especially if the primary breadwinner passes away. The death benefit can cover funeral expenses, pay off debts, and provide income to replace lost wages. For example, it can help with paying for children’s education or maintaining the family’s current lifestyle.

Term life insurance has been particularly impactful for families with young children or those with significant financial obligations like mortgages. Many people use it as a safety net during the years when they are working and have dependents, ensuring their family’s financial needs are met if the worst happens.

Life Insurance Trends: Age and Gender Differences

Age Group Trends: Younger people (typically those aged 25-45) are more likely to purchase term life insurance because of its affordability and the financial responsibilities they face, such as paying off student loans, mortgages, or raising children. As people age, particularly after 50, they lean towards more permanent options like whole life insurance as they look for lifelong coverage and cash value accumulation

Gender Differences: Men generally pay higher premiums than women because they statistically have shorter lifespans. However, both genders are increasingly purchasing life insurance due to a heightened awareness of its importance, especially after significant events like the COVID-19 pandemic.

Why Life Insurance is Important in 2024 and Beyond

The importance of life insurance is growing, as people recognize the unpredictable nature of life events. In a recent CNN discussion, experts highlighted the increasing demand for life insurance, particularly due to the financial uncertainties brought on by the pandemic. The demand for travel insurance and life insurance is expected to rise by 20-30% by 2026 as more people see it as a necessary form of financial protection

Best Life Insurance Providers in the USA and UK

- In the USA: Companies like State Farm, Northwestern Mutual, and Guardian are often ranked among the best for offering competitive term life policies with flexible terms and robust customer service.

- In the UK: Aviva and Legal & General are considered strong options, known for providing comprehensive life insurance solutions

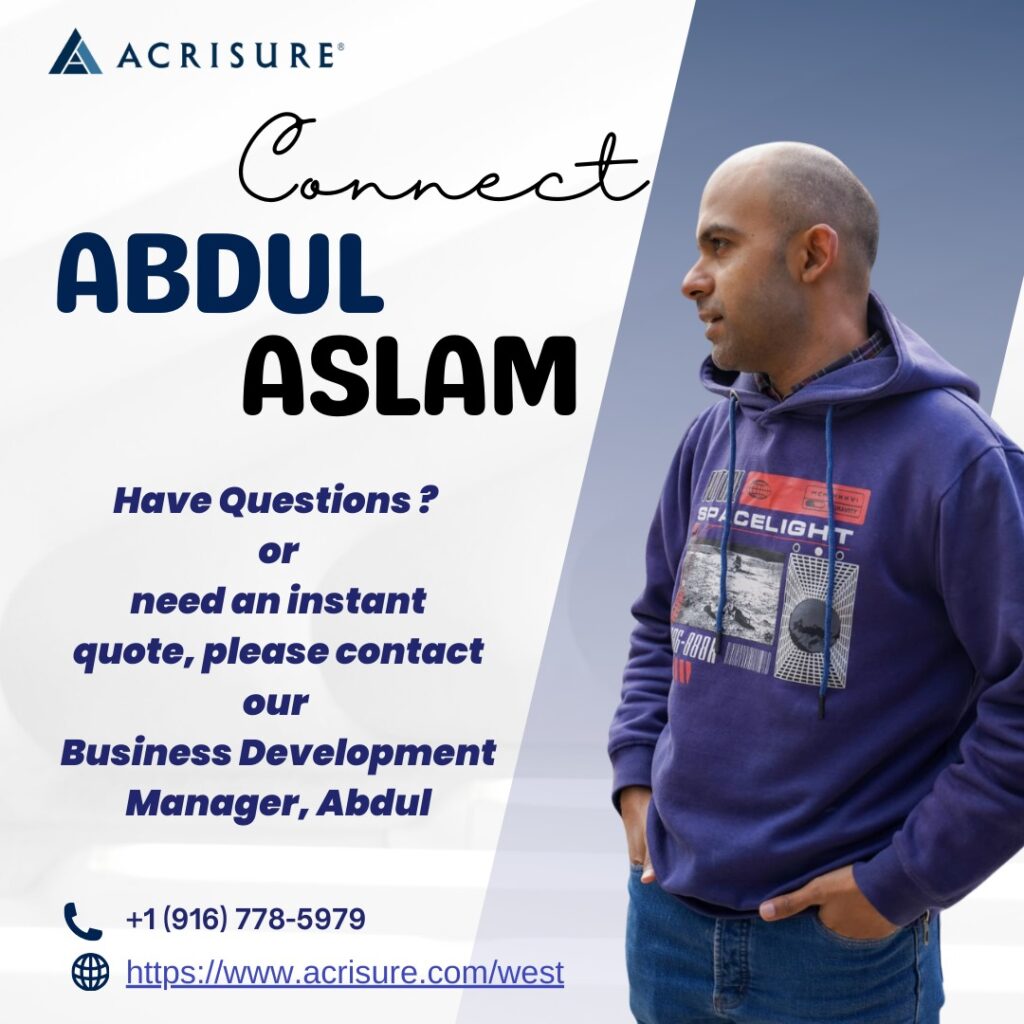

Why Choose Acrisure with Abdul Aslam?

If you’re considering purchasing life insurance, Acrisure could be your best choice. Abdul Aslam, a Business Development Manager at Acrisure, specializes in providing personalized solutions that fit your individual needs. With expertise in both business and personal insurance, Abdul can help you find a policy that offers peace of mind at the most competitive rates.

Whether you’re looking for term life insurance or something more permanent, Abdul can guide you through the process to ensure your family is well-protected.

Contact Abdul Aslam at 916-778-5979 today for expert guidance on selecting the right life insurance policy!