Massachusetts Health Insurance Rebates: $75.6M Heading Back to Consumers – Here’s What to Know

BOSTON — Imagine opening your mailbox this fall and finding a check from your health insurance company. That’s the reality for more than 350,000 Massachusetts residents and small-business employees who will soon share in $75.6 million in health insurance rebates. The Healey-Driscoll administration confirmed this week that five major insurers will be issuing refunds, […]

Why Selling Your Life Insurance Policy May Be Smarter Than Letting It Lapse

If you’re 65 or older and own a life insurance policy, you may be able to sell it for far more than what your insurance company would offer if you surrendered it—or worse, let it lapse and get nothing. In fact, according to the Life Insurance Settlement Association (LISA), seniors who sold their policies through […]

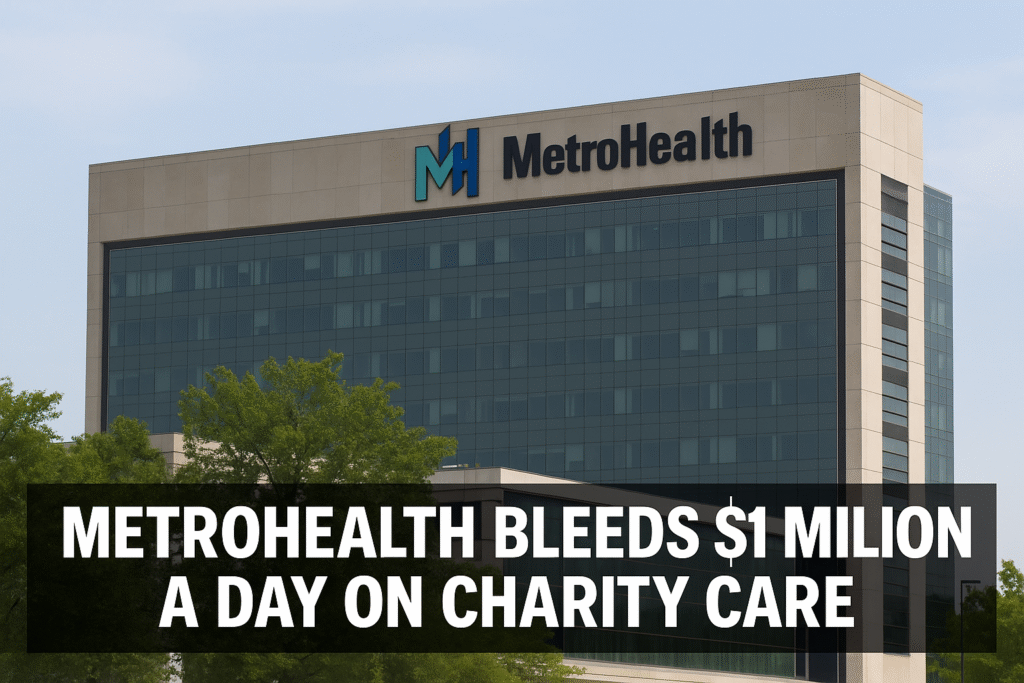

MetroHealth Expands Insurance Enrollment Push as Charity Care Costs Hit $1 Million a Day

CLEVELAND, Ohio — MetroHealth System is stepping up efforts to get more patients signed up for health insurance as the hospital faces a staggering financial challenge: charity care now costs the health system more than $1 million every single day. The move comes as MetroHealth, Cuyahoga County’s safety-net hospital, battles steep operating losses and uncertainty […]

Rising Insurance Costs Are Pushing Homebuyers to the Breaking Point

The dream of homeownership in America is becoming harder to achieve—not only because of rising mortgage rates and record home prices, but also due to soaring homeowners insurance premiums. Just a decade ago, mortgage brokers like Andrew Cady of UMortgage in Inlet Beach, Florida, would set aside about $120 per month for insurance when qualifying […]

Can You Have Multiple Life Insurance Policies?

Can You Have Multiple Life Insurance Policies? Many people wonder if it’s possible to hold more than one life insurance policy at a time. The short answer is yes! Having multiple life insurance policies can provide additional coverage and flexibility tailored to your financial needs. In this article, we’ll explore the implications of having multiple […]

Should a 65 Year Old have Life Insurance?

As individuals reach the age of 65, many begin to ponder the relevance of life insurance in their financial planning. This age often marks a significant transition into retirement, prompting questions about financial security, family obligations, and overall health. In this article, we’ll explore whether a 65-year-old should consider life insurance, the options available for […]

How Can I Borrow Money From My Life Insurance Policy?

How Can I Borrow Money From My Life Insurance Policy? Life insurance policies, especially permanent ones like whole life or universal life insurance, are not just for providing security to your loved ones after you’re gone—they can also serve as a financial resource during your lifetime. If your policy has accumulated cash value, you can […]

Where Does Life Insurance Dividend Go

Understanding Life Insurance Dividends: A Guide to Where Your Dividends Go Life insurance dividends can be a complex topic for policyholders, partly due to the way insurance agents and companies explain them. These dividends might seem similar to stock dividends, but they operate differently. In this guide, we’ll cover what life insurance dividends are, the […]

what is the difference between term and whole life insurance

Selecting the right life insurance policy is an important step in securing your financial future. Both term life insurance and whole life insurance offer unique benefits, but they cater to different financial needs and goals. To help make this decision easier, here’s an in-depth comparison of the two. For further questions or a customized quote, […]

what is the difference between term and whole life insurance

Understanding the differences between term and whole life insurance is essential for making well-informed decisions about life insurance. Each type offers unique benefits depending on your financial goals, budget, and long-term needs. Below is a detailed comparison to help you determine which one may be right for you. For any questions or a personalized quote, […]